According to the Usage-Based Insurance Market Report 2022 by Research and Markets, the market is expected to grow to $132.02 billion in 2026 at a compound annual growth rate (CAGR) of 24.9%. The growth is mainly propelled by the expansion of the automotive industry. With such a huge market potential, thinking one step ahead will give insurers a significant competitive advantage.

Jimi’s Usage Based Insurance (UBI) telematics solution provides a variety of data regarding how policyholders drive, when they drive, and where they drive. This data is presented in intuitive graphs and lists, enabling auto insurance companies to offer low premiums to low-risk drivers and high premiums to high-risk drivers and to motivate high-risk drivers to correct their driving habits. Apparently, this will help auto insurance companies win and retain customers, improve operational efficiency, and make claim processing more efficient.

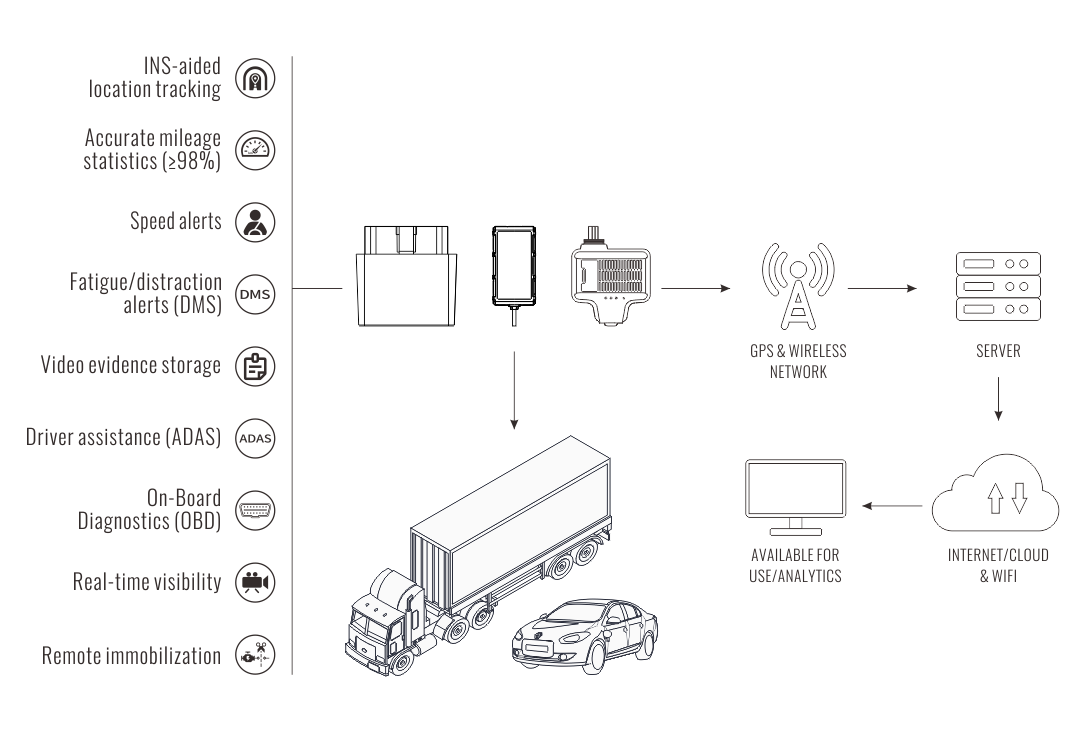

·INS-aided GPS Tracking

·Driving Behavior Analysis (Advanced)

·Mileage Accuracy ≥98%

·INS-aided GPS Tracking

·4G LTE Communication

·Driving Behavior Analysis (Advanced)

·LTE & GSM Network

·On-Board Diagnostics

·GPS & BDS Positioning

EN

EN ES

ES PT

PT TH

TH VN

VN JP

JP